Workplace Safety – How Workplace Injury Law Makes a Difference?

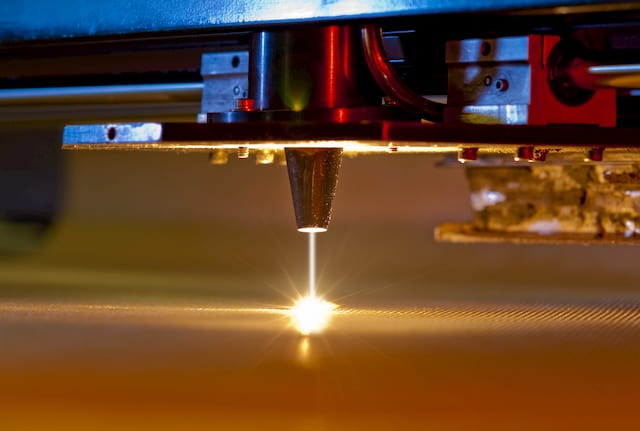

Workplace safety is a fundamental concern for both employees and employers. In an ideal world, every worker should be able to perform their duties without fear of injury or harm. However, the reality often falls short of this ideal, and workplace injuries continue to be a pressing issue. This is where workplace injury law plays a crucial role in making a difference. It serves as a set of regulations and legal frameworks designed to protect employees and hold employers accountable for maintaining safe working conditions. In this paragraph, we will explore how workplace injury laws contribute to championing workplace safety, the benefits they provide, and the impact they have on preventing accidents and injuries. First and foremost, workplace injury laws establish a standard of safety that employers must adhere to, ensuring that employees are not subjected to hazardous conditions. These laws typically include requirements for safety equipment, training, and reporting of workplace injuries.

For instance, employers may be legally obligated to provide safety gear, such as helmets or protective clothing, for workers in high-risk environments like construction sites. Moreover, they must offer proper training to reduce the likelihood of accidents. In the event of a workplace injury, these laws mandate that employers promptly report the incident to the relevant authorities, enabling a timely investigation into the causes and possible negligence. Workplace injury laws also empower employees by giving them recourse in the event of an accident. This not only covers their medical expenses but also provides compensation for lost wages and rehabilitation costs. When workers know that their rights are protected by law, they are more likely to report unsafe conditions or accidents without fear of retaliation click now to more about it. This transparency encourages employers to prioritize safety, leading to a decrease in workplace injuries over time.

Furthermore, workplace injury laws play a significant role in holding employers accountable for negligence or disregard for safety regulations. When employers face legal consequences for failing to provide a safe work environment, they are incentivized to invest in safety measures and preventive measures. By imposing fines or even criminal charges in severe cases, the law serves as a deterrent against cutting corners and compromising employee well-being. In conclusion, championing workplace safety through workplace injury laws is essential for the well-being of employees and the overall productivity of the workforce. These laws establish standards that employers must meet, provide employees with the means to seek compensation and protection, and hold employers accountable for any lapses in safety. By creating a framework that emphasizes safety and enforces compliance, workplace injury laws are instrumental in reducing the number of workplace accidents and injuries, ultimately fostering a safer and more secure work environment for everyone involved.